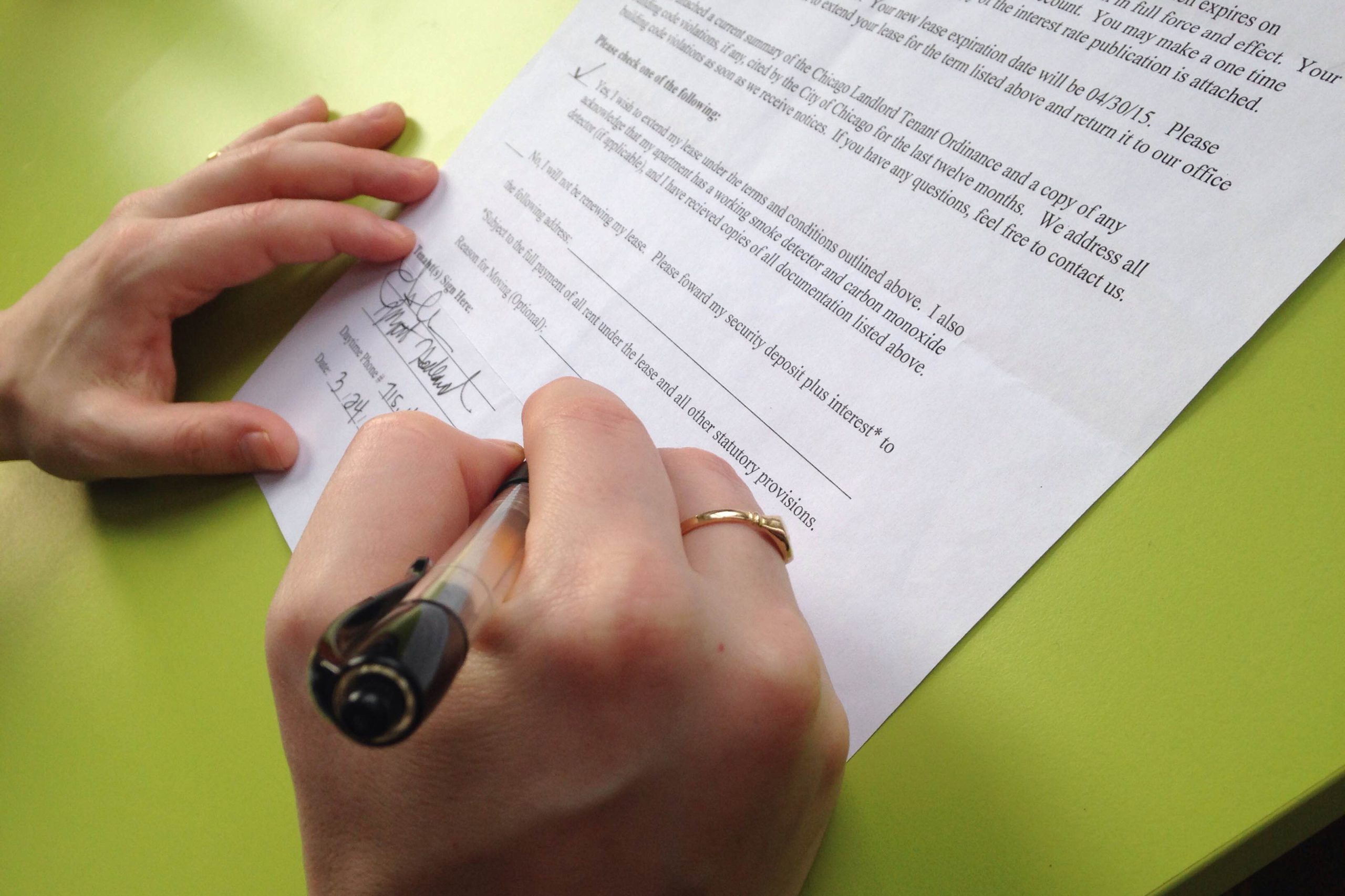

Payment incidents, also known as account transaction incidents, are those where the bank rejects the transaction due to lack of funds or fraudulent billing on the overdraft account. If you are in this type of situation and want to know how to manage a payment incident, this section is for you!

Manage a payment incident by regularizing NSF checks

If the bank fails to reach a settlement on the first statement, an injunction will be issued, resulting in a five-year banking and reporting ban. Fortunately, you can correct the situation before this deadline by reimbursing the recipient of the check anyway.

The first result of issuing an NSF check is economic. Indeed, when paying by check, the bank must go through a few steps. This includes in particular the opening of a file, the sending of a letter or the processing of the opposition itself. So many "services" that are not free.

Banks process these procedures very quickly. The purpose of this contact is to inform you of the situation and to invite you to debit your account as soon as possible. If you do not have the required amount, you will receive a “cease and desist” letter by registered mail. This letter has serious consequences. You no longer have the right to write any other cheques. After that, “banking ban” is declared.

If the check in question is less than €50, the penalty can go up to €30 per check. Higher amounts can be fined up to €50 per settlement.

If you are faced with such situations within your company, your store or your design office, Recovry can advise you on how to better manage a payment incident. It is an expert debt collection company with 25 years of experience. You can contact her in complete confidence if you wish to lodge a complaint following the issuance of an NSF cheque.

Penalties following the issuance of an NSF check

Banking bans are much broader than the inability to hold or write a check. This limit applies to all accounts, even those held by another bank until your situation is resolved. Unless you take steps to lift it as soon as possible, the ban will last five years and will be registered with the FCC of the Banque de France.

What to do following the issuance of check NSF?

The forbidden lift bank is a relatively easy procedure. Some solutions can be considered. You can pay payees to the verification amount by other means such as cash. In this case, it is up to you to contact the beneficiaries and collect the check. It will be used as evidence.

You can also deposit the amount of the check into your bank account and then ask the recipient to deposit it again. Simply deposit a check on your bank statement to prove to your bank that the incident will be closed and released.

If you are not in contact with the recipient, you can permanently block the amount of the check on your account. Once you have the amount you need, ask the bank to put it on hold so you can't spend the money on anything other than paying the disputed check. Blocking will lift the ban on the bank whether or not the check is represented by the beneficiary. In the latter case, the amount will be announced one year and one day after the legal deadline. Use an expert service like Revovry to better guide you through the process.

In short, issuing an NSF check is not a crime in itself. In order to manage a payment incident, the wisest thing is to settle the situation amicably. Major banking institutions are working to find personalized solutions for customers facing serious financial difficulties. However, repeated NSF checks can have a devastating impact on already struggling finances.